Over the years, our firm has built a well-defined 5-step consulting process. It addresses investment consulting, advanced planning issues, tax strategies, estate planning, charitable giving and protecting wealth from being unjustly taken. We’ve assembled a team of Austin financial experts who we consider the best legal, accounting and insurance minds that have been vetted to be part of our virtual family office structure. We collaborate together to come up with powerful ideas to help our families make smart decisions about their money.

These specialists who are part of REAP Financial “fill in the gaps” by providing the expertise that REAP Financial does not specialize in. This is an important point because no one professional — not even the smartest investor or tax attorney — have all of the connections needed to serve the complex needs of affluent families.

REAP Financial stays in close contact with the family to help ensure the various specialists are delivering as promised. As coordinator, REAP Financial also works closely with the family to make sure the desired results are achieved.

Building a Total Client Profile

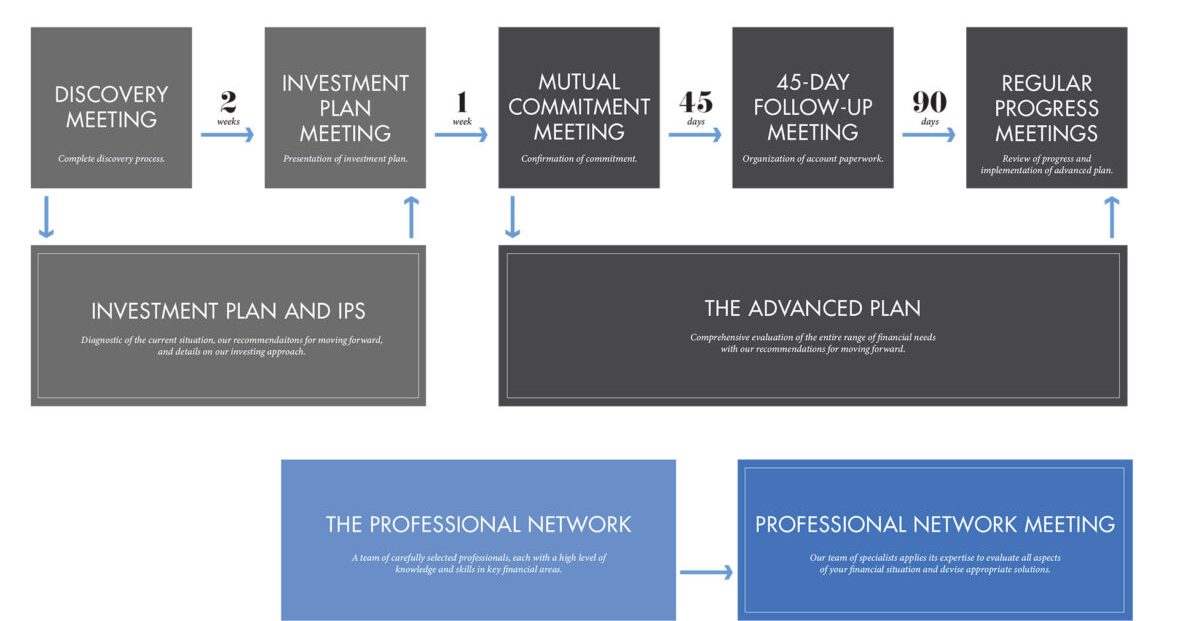

We start by getting to know you through a discovery process, after which we put together a Total Client Profile. This captures your goals, essential relationships, interests and values.

A Team Approach

The collective perspective of a team, rather than one individual’s advice, is critical to effective wealth management. At REAP Financial, we use a consultative process that brings together various professionals to collaborate on tax planning, estate planning, assets protection and charitable giving strategies to see if any gaps exist in your current plan.

Progress Meetings

Bringing together these Austin financial professionals provides for key brainstorming conversations that allow us to come up with actionable steps to address the gaps. These steps are measured and tracked as an action plan that is put in place on things you wish to address first. Once we have a comprehensive road map for goals, we regularly monitor your portfolio in accordance with your objectives.